Yen gains, bond yields rise after BOJ hikes rates

By Kevin Buckland

TOKYO (Reuters) – The yen strengthened and Japanese government bond yields rose to fresh multi-year highs on Friday after the Bank of Japan hiked interest rates as expected and raised its inflation forecasts.

Japan’s Nikkei share average pared earlier gains to up 0.26% at 40,062.48 as of 0405 GMT, after ending the morning session up 0.6%.

The yen was about 0.5% stronger at 155.32 per dollar, after initially swinging between small gains and losses immediately after the decision, which came close to the end of the stock market’s midday recess.

The two-year JGB yield ticked up an additional half a basis point (bp) after the policy announcement to be 1 bp higher at 0.705% on the day, a level last seen in October 2008. The five-year yield climbed 2 bps to 0.895%, the highest since December 2008.

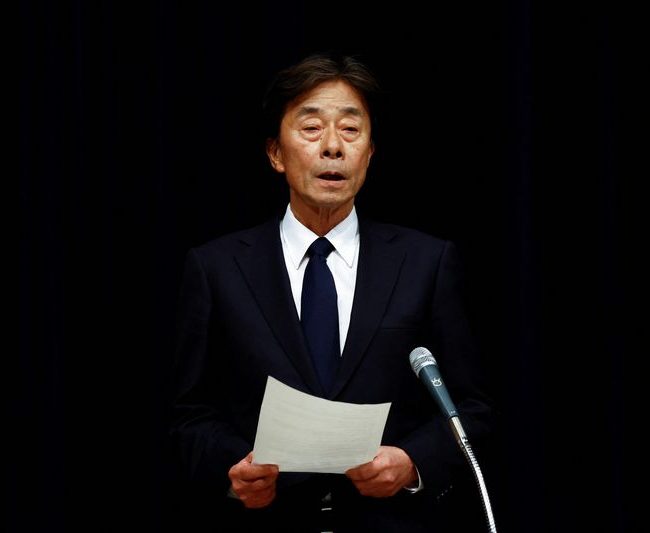

The BOJ hiked short-term lending rates by a quarter point to 0.5%, which had been already priced into money markets after central bank officials, including Governor Kazuo Ueda, had clearly signalled earlier this month that policy tightening was on the table.

In its quarterly outlook report, the board raised its forecast for core consumer inflation to hit 2.4% in fiscal 2025 before slowing to 2.0% in 2026. In the previous projection made in October, it expected inflation to hit 1.9% in both fiscal 2025 and 2026.

Investor focus now falls on Ueda’s news conference, scheduled for 0630 GMT, for clues on the pace of further tightening. The market is currently priced for one further quarter-point increase by year-end.

“I expect the rate will be kept the same for at least the next six months,” keeping the pace broadly the same with hikes so far this cycle, said Kota Suzuki, a strategist at Nomura Asset Management.

“The central bank will be a little more cautious from now on as it will carefully assess the economic situation and the impact of the interest rate hike.”

Early gains in Japanese stocks came on the back of a 0.5% rise in the U.S. S&P 500 (SPX) overnight to mark its first closing record since Dec. 6.

The yen was supported by comments from U.S. President Donald Trump that he thought he could reach a trade deal with China and avoid additional tariffs.