Top 10 fiscal economic stories of 2024

I have listed what I consider the major fiscal/economics trends of this year. The first five are global, the next five are local or Philippine issues.

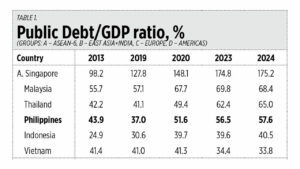

1. The government or public debt to GDP ratio continues to deteriorate in many countries. Among the ASEAN-6, Indonesia, the Philippines, Singapore, and Thailand are projected to have had higher ratios in 2024 than in 2023.

2. Among developed Asian nations, only Singapore and Japan have debt/GDP ratios of above 100%. But these are largely domestic debt or borrowing from their own citizens and companies and, hence, have no or little threat of debt default. Meanwhile, major European and American countries continue to have ratios of above 100% or rising ratios, except for Germany, Russia, and Argentina (see Table 1).

3. Argentina gets a fiscal shock with the abolition of 10 government ministries. Argentina’s free marketer and libertarian president, Javier Milei, took office in December 2023 and made deep cuts in expenditures, produced a fiscal surplus within the first two months, and, in 2024, the country’s first fiscal surplus in 123 years. First, he merged six ministries — Public Works, Housing, Transportation, Energy, Mining, and Telecommunications — into a single Ministry of Infrastructure, abolishing five. Then he abolished five other ministries — Culture, Education, Health, Labor, and Social Development — and instead created the Ministry of Human Capital. Argentina’s Debt/GDP ratio is projected to decline from 155% in 2023 to 92% this year.

4. US outstanding public debt has breached $36 trillion. By the end of 2016, or last year of the Obama administration, US public debt was $19.98 trillion. It rose to $23.2 trillion by the end of 2019 or the third year of Donald Trump’s first presidency. But then the COVID-19 lockdowns happened in 2020 and borrowings expanded, and debt reached $27.75 trillion that year. Under Joe Biden it rose to $29.62 trillion in 2021, $34 trillion in 2023, and $36.19 trillion as of Dec. 23 this year. Or an average increase of $2.11 trillion/year under Biden.

5. All G7 members are in the list of the top 10 debtor countries in the world. Their combined outstanding debt is $61.29 trillion — huge! — and this number does not yet include their guaranteed debt and unfunded liabilities like elaborate pensions. In contrast, the combined outstanding debt of the BRICS nations (Brazil, Russia, China, India, and South Africa with $302 billion) is $22.35 trillion (see Table 2).

6. The Philippine budget deficit went from P1.54 trillion/year from 2020-2023, to around P1.16 trillion in 2024. This from only P660 billion in 2019. The actual deficit from January-October in 2024 was P964 billion. Financing or borrowings increased from P876 in 2019 to P2.2 trillion/year from 2020-2023 and is projected to hit P1.45 trillion in 2024. Interest payments from high levels of public debt increased from P360 billion in 2019 to P503 billion in 2022 and are projected to reach P767 billion in 2024.

7. The Philippines’ public debt has reached P16 trillion. Outstanding debt as of October was P16.02 trillion actual, plus a debt guarantee of P412 billion, for a total outstanding debt of P16.43 trillion (see Table 3).

8. The idle funds of the Philippine Health Insurance Corp. or PhilHealth were used to finance the government’s unprogrammed appropriations. Finance Secretary Ralph G. Recto was bombarded by criticism by the health activism community this year because the good Secretary wanted to fund many health and infrastructure projects — worth P90 billion— without new borrowings nor seeking new or higher taxes. This money comes not from contributions by PhilHealth members but from drinkers, smokers, vapers, and gamblers via excise taxes on tobacco, vapes, and alcohol, and the remittances from the Philippine Amusement and Gaming Corp., better known as Pagcor, which are directed to PhilHealth. The P90 billion is the accumulated net flow from 2021-2023 of government premium from sin taxes minus benefit claims by non-contributing members. In my opinion, Mr. Recto is correct and the detractors are wrong.

9. The funds of the Department of Health (DoH) and PhilHealth have declined mainly due to a decline in tobacco taxes. The health activist community also attacked the Department of Budget and Management (DBM) for submitting a lower budget for DoH and PhilHealth for 2025. But this group is perfectly aware that 50% of the tobacco-alcohol tax is allotted to DoH-PhilHealth and that the tax has been declining due to rampant smuggling and illicit trade as the tobacco tax rates are rising yearly. Tobacco tax revenue peaked at P176 billion in 2021 when the tax rate was P50/pack. This declined to P160 billion in 2022 at the tax rate increased to P55/pack, then P135 billion in 2023 at P60/pack, and it is projected to be around P120 billion in 2024 at a tax rate of P63/pack. In my view, the DBM is correct and its detractors are wrong.

10. The enactment of the CREATE MORE law and an income tax cut. RA 12066 or the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy law (CREATE MORE) was signed into law on Nov. 11. Among its key provisions is further reduction in the corporate income tax (CIT) rate from 25% to 20% for Registered Business Enterprises (RBEs) under the Enhanced Deductions Regime (EDR) on their taxable income derived from registered projects or activities during the taxable year.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.