U.S. PCE data: tech stocks could ‘continue to run up’

U.S. PCE data: tech stocks could ‘continue to run up’ | Invezz

Victoria Greene remains constructive on big cap tech stocks.

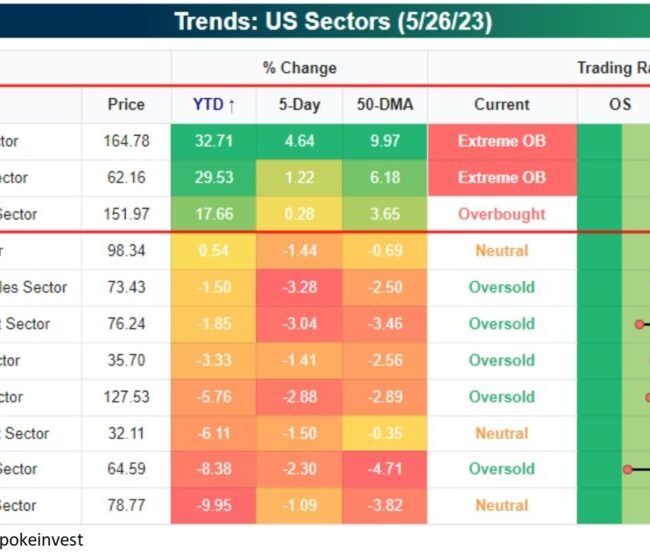

Tech-heavy Nasdaq Composite is up more than 22% year-to-date.

Follow Invezz on Telegram, Twitter, and Google News for instant updates >

Nasdaq Composite is in focus this morning after the U.S. Bureau of Labour of Statistics said the core personal consumption expenditures price index was up more than expected in April.

For the month, the Fed’s preferred inflation gauge rose 0.4% – supporting the narrative that rates could remain higher for longer.

Still, Victoria Greene – the Chief Investment Officer of G Squared Private Wealth is convinced that the ongoing rally in tech stocks is far from over yet.

Being concentrated in mega-cap tech stocks has been where to be in this market. It’ll probably continue to run up. You can’t deny the potential in AI, you can’t deny the earnings prowess these companies have.

On an annual basis, the core PCE was up 4.7%. Economists had forecast the reading at 0.3% for the month and 4.6% for the year.

Headline PCE, including food and energy, climbed 0.4% for the month and 4.4% for the year – also above the Dow Jones estimates.

Despite stubbornly high inflation, consumer spending increased 0.8% in April versus a 0.4% jump expected. Greene also said today on CNBC’s “Worldwide Exchange”:

I think investors see some of them [big cap tech stocks] as safe haven. Then potential growth from tech advancements and what AI could bring is intriguing. So, I think right now you play the hot hand.

At writing, the tech-heavy index is up more than 22% versus the start of the year. BEA also reported a 0.4% increase in personal income for April on Friday.

Ad

Copy expert traders easily with eToro. Invest in stocks like Tesla & Apple. Instantly trade ETFs like FTSE 100 & S&P 500. Sign-up in minutes.

10/10

77% of retail CFD accounts lose money.

Get demo account

Economic

USA

Economic

Indices

North America

Stock Market

World